Investor confidence, bolstered by key macroeconomic shifts and the anticipation of significant upcoming events like the Bitcoin halving and the introduction of ETFs, is fueling today’s surge in the cryptocurrency market

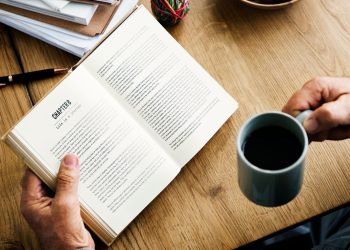

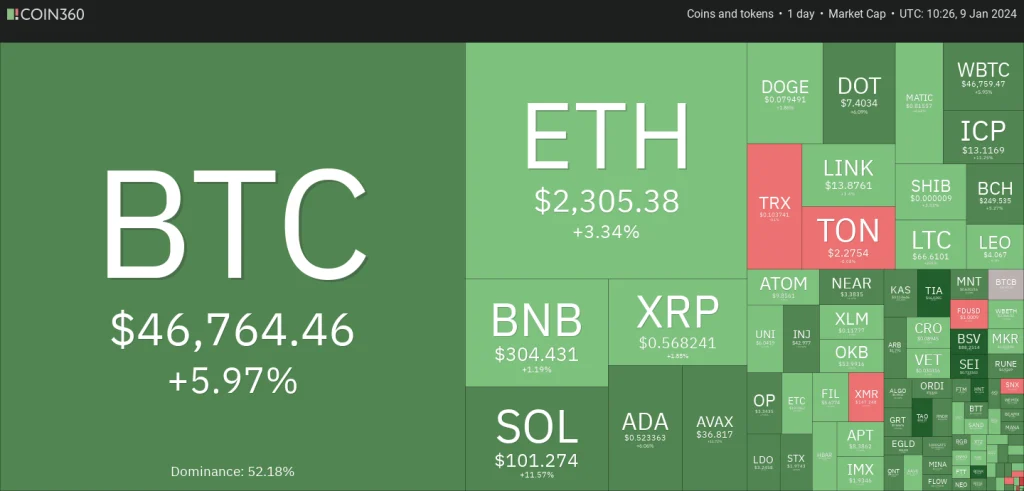

The total market capitalization of all cryptocurrencies has experienced a notable increase of 6.50%, reaching $1.7 trillion over the past 24 hours. Leading this surge, the top coins Bitcoin and Ether have shown significant gains, with Bitcoin rising by 6% and Ether by 3.5%.

Bitcoin ETF approval expectations

Today’s upward momentum in the cryptocurrency market is largely attributed to the anticipation surrounding the U.S. Securities and Exchange Commission’s (SEC) potential approval of the first spot-based Bitcoin ETFs. This expected approval is viewed by the market as an indicator of a broadening investor base. Standard Chartered has even projected that this development could catalyze a significant Bitcoin price rally, potentially reaching $200,000 by the end of 2025.

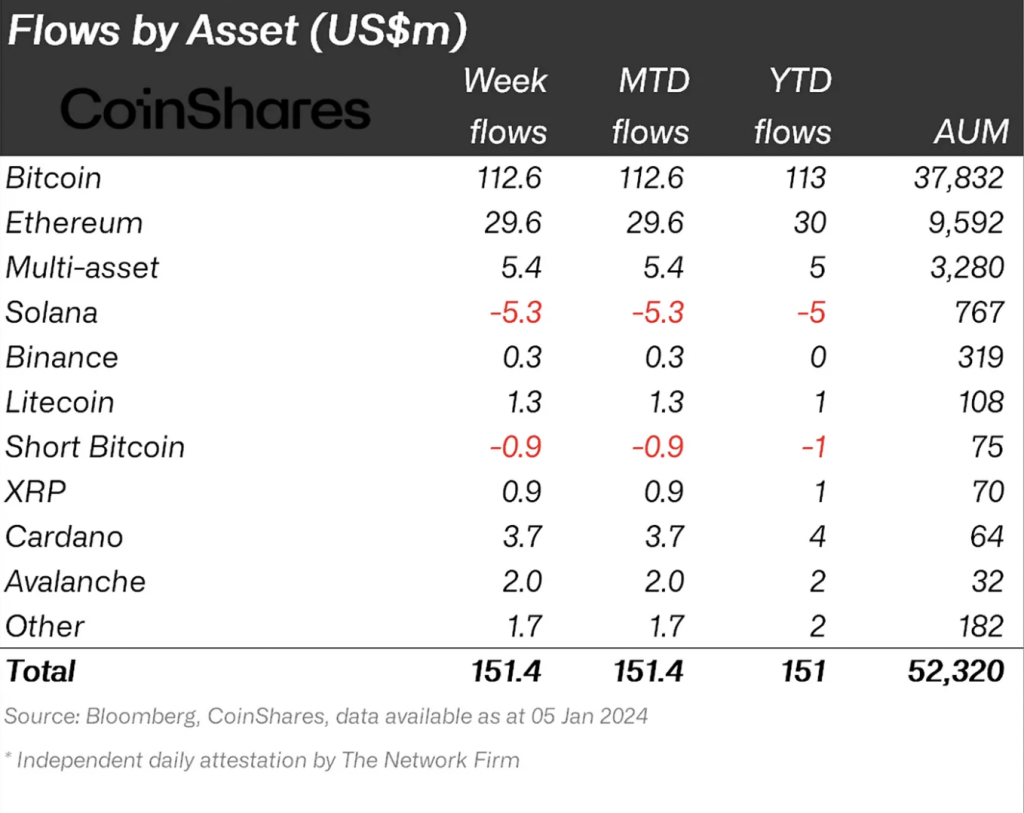

In 2024, the trend for digital assets investment funds has been distinctly positive, marked by an upward momentum. This is evidenced by a significant inflow of $151 million, reflecting increased investor interest and confidence in the digital assets space.

Tech stock rally, dollar’s decline

Tech stock rally, dollar’s decline

The daily correlation between the crypto market and the tech-centric Nasdaq Composite Index (IXIC) has remained positive since November 2023. During this period, the crypto market and the Nasdaq Composite have recorded impressive gains of 40% and 18.5%, respectively. Concurrently, the U.S. Dollar Index (DXY), which measures the strength of the dollar against a basket of major currencies, has experienced a decline of 4.45%.

Bitcoin halving less than 100 days away

The current bullish sentiment in the cryptocurrency market is further amplified by the upcoming Bitcoin halving event, which is now less than 100 days away. This halving will reduce the rate of new Bitcoin supply by half, a phenomenon that has historically led to an increase in Bitcoin’s price.

These various factors together provide a comprehensive understanding of the driving forces behind the ongoing rally in the cryptocurrency market. Among these, the anticipated decision by the SEC on Bitcoin ETFs stands out as particularly significant. This decision is expected to have profound and lasting impacts on the market’s dynamics and the composition of the investor base.

This article is for informational purposes only and does not constitute investment advice or recommendations. Each investment and trading decision involves risk, and readers are advised to perform their own research and due diligence before making any financial decisions.